Trusted by 50,000 clients worldwide, we deliver unbiased,

in-depth research for more than 1,000 issuers around the globe.

Features

Smart Features, Sharper Insights.

CreditSights Product Updates

Stay ahead with CreditSights’ latest product enhancements, providing cutting-edge tools and insights to empower your investment strategies.

New

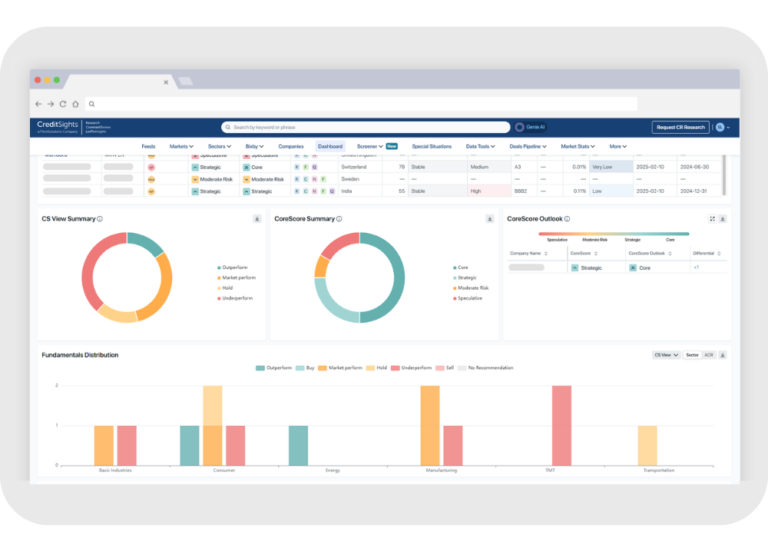

Dashboards

Access a comprehensive suite of tools that allow you to monitor, analyze, and manage your investment portfolio with ease. By integrating our Fundamental Research data, including CS Views and CoreScores, our Dashboards offer a holistic view of your investments, helping you stay ahead in the market.

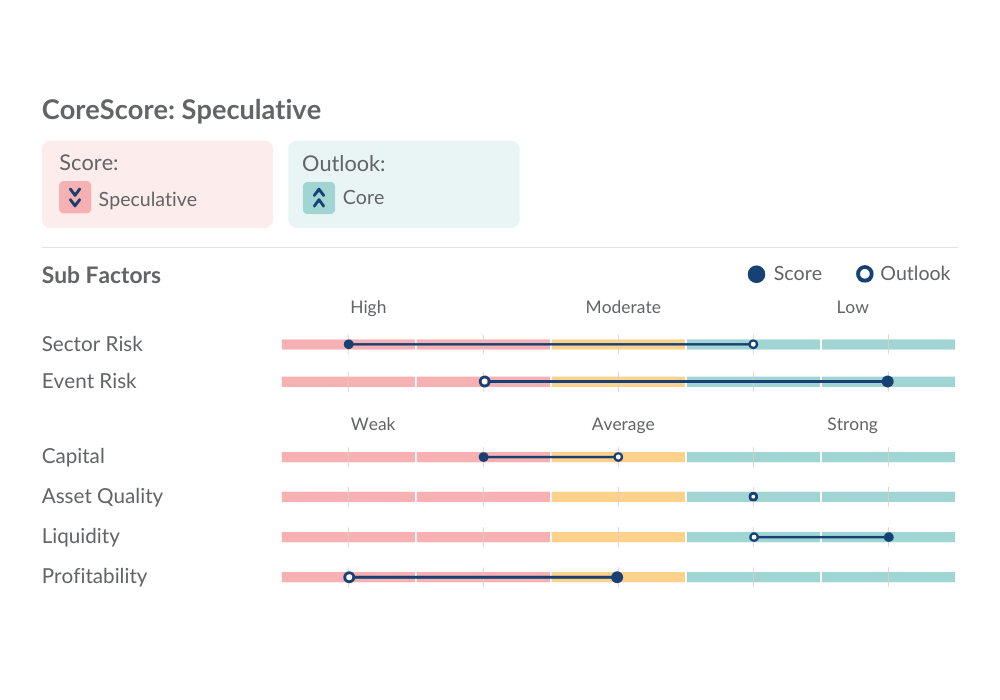

CoreScores

Enhance your portfolio with CoreScores, an innovative tool that refines buy-and-hold strategies by evaluating credit factors, offering a clear path to long-term returns and aligning seamlessly with CS View insights.

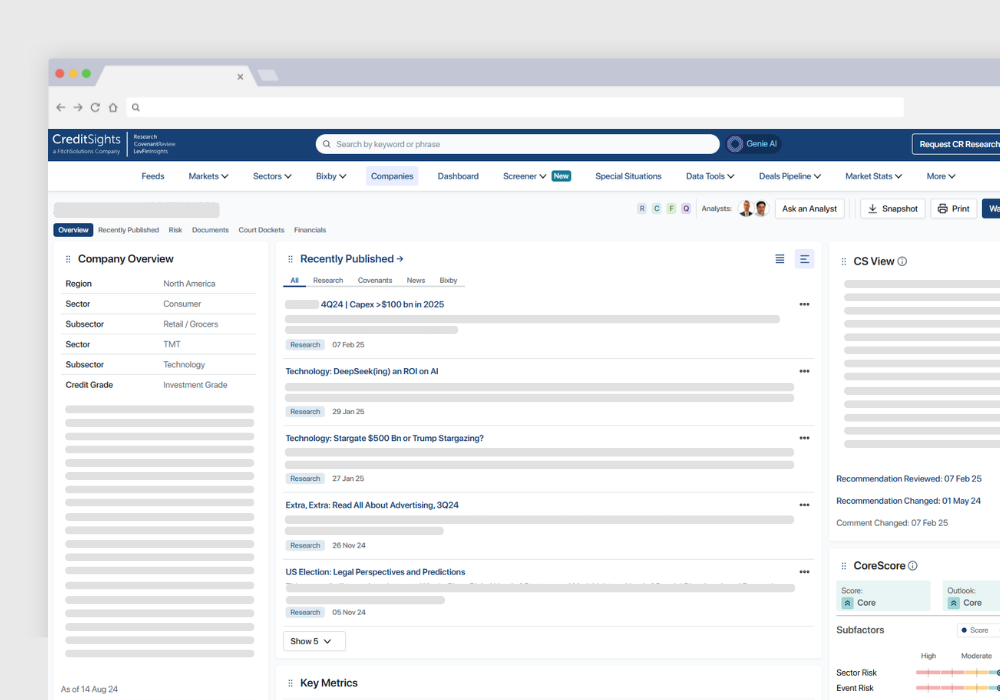

Company Pages

We offer comprehensive insights on over 30,000 issuers, integrating financial data, expert recommendations, risk scores, documents, events, deals, and research in a flexible, accessible layout.

NAVIGATE THE MARKET CONFIDENTLY

Our Coverage

Our global team of research analysts produces award-winning research, leveraging their local expertise, sector knowledge, and market experience to deliver deep insights into issuers, credits, and key market developments.

Which market segments are included in our coverage?

At CreditSights, we provide comprehensive coverage of debt issuers and their securities across diverse market segments, including:

- Debt Issuance: Insights into global trends and investment-grade markets.

- Emerging Markets: Fundamental research on developing economies.

- High Yield: Analysis of high-yield securities from over 1,000 issuers.

- Asia Pacific: Macro and micro analysis of credits in the region.

- Special Situations: Research on debt in financial distress.

- Strategy: Analysis of macro trends in credit markets.

- U.S. Municipal: Insights on U.S. government entity credits.

- Credit ETFs: Research on bond-focused exchange-traded funds.

What reports are included with a CreditSights Research subscription?

A research subscription offers access to a wide range of reports, including:

- Earnings Reports

- New Issue Reports

- Company Reports

- Sector Reports

- Strategy Reports

- Municipal Reports

- Outlook Reports

- Emerging Markets Reports

- Primers

Our Solution

Discover unparalleled access and integration with our diverse range of delivery methods, designed to cater to your needs.

Every delivery method is tailored to fit seamlessly into your professional routine, providing the right information at the right time, in the most efficient way possible. With CreditSights, it’s not just about data — it’s about transforming information into actionable intelligence that drives your business forward.

Our Platform

Our comprehensive website platform gives you the tools to navigate through a wealth of our analysis and data. The intuitive design ensures a user-friendly experience, providing quick and thorough research capabilities.

API Feed

Streamline your workflow with our API feeds. Automated and tailored, these feeds ensure that our insights are seamlessly integrated into your internal systems.

Bloomberg Feed

Access our research through your Bloomberg terminal, ensuring an uninterrupted workflow and immediate insights.

Third-Party

Access our research through third-parties such as Tradeweb, ensuring an uninterrupted workflow and immediate insights.

Mobile App

Stay informed wherever you are with our mobile app, the perfect companion for professionals who demand excellence at their fingertips.

Excel Add-in

Enhance your data analysis and reporting within Excel using our add-in. Integrate the power of our data directly into your spreadsheets, allowing for dynamic and powerful financial modeling.

Unlock Valuable Insights with our Free Resources

Access a hand-picked selection of our comprehensive research studies at no cost. Click to download and start exploring groundbreaking insights today!

Stay in the Know: Request a CreditSights Trial

Request a trial and discover how our data and tools can help you do your best work.

Once you complete the form, one of our specialists will be in touch to arrange an appropriate time to discuss.