The #1 Source for Your Leveraged Finance Intel

Jump to the forefront of finance with up-to-the-minute reporting on everything from loans to high-yield bonds, and private credit to CLOs. Experience the stories as they unfold, from the first whisper of a deal to the final hammer of the gavel. We deliver news, data and research on new deals, people moves, earnings and more within the leveraged finance market. Our team fills in deal minutiae and broader market trends with color from high-level, long-standing relationships.

Features

Decode Market Movements

LevFin Insights’ Offering

In-depth News, Data & Analysis Covering the Credit Markets

Unmatched News Coverage

Get real-time updates on loans, bonds, private credit, and CLOs. Track developments and access comprehensive news and analysis on deals and changes in leveraged finance.

Understand Market Changes

Our Trends & Analysis offers deep insights into market shifts, highlighting both minor changes and major transformations in the financial landscape.

Unrivaled Deal Directory

Get detailed updates on M&A, pipelines, repayment plans, and corporate news. Strengthen your strategy with focused trend reports.

Unbeatable Data-Driven Analysis

Explore over 1,000 Structured Finance deals and unique credit situations with our platform, offering detailed market views since 2016 for informed decision-making.

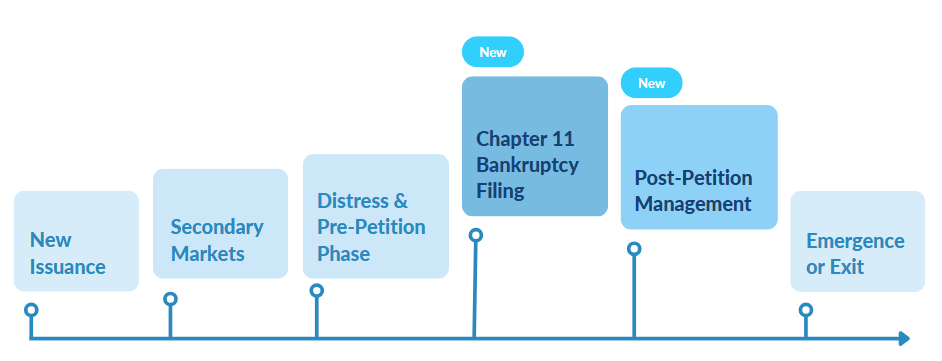

Navigate the Complexities of Chapter 11 and Bankruptcies with our Post-Petition Offering.

Discover our Post-Petition offering – your key resource for navigating the intricacies of chapter 11 and post-petition debt in the US leveraged finance market. Access real-time bankruptcy court dockets, in-depth news, and expert legal research, all tailored to enhance your investment decisions.

Enhance Your Investment Decisions with our Private Credit Offering

Our Private Credit Offering delivers comprehensive analysis on individual loans and benchmarks against our extensive dataset of private credit loans. Our analysis of over 2,500 private credit agreements uncovers significant market trends, helping you see how your deals align with industry standards.

Unlock Valuable Insights with our Free Resources

Access a hand-picked selection of our comprehensive research at no cost. Click to download and start exploring groundbreaking insights today!

Sign up to receive our latest credit insights direct to your inbox.

Our Solution

Discover unparalleled access and integration with our diverse range of delivery methods, designed to cater to your needs.

Every delivery method is tailored to fit seamlessly into your professional routine, providing the right information at the right time, in the most efficient way possible. With CreditSights, it’s not just about data — it’s about transforming information into actionable intelligence that drives your business forward.

Our Platform

Our comprehensive website platform gives you the tools to navigate through a wealth of our analysis and data. The intuitive design ensures a user-friendly experience, providing quick and thorough research capabilities.

API Feed

Streamline your workflow with our API feeds. Automated and tailored, these feeds ensure that our insights are seamlessly integrated into your internal systems.

Third-Party

Access our research through third-parties such as S&P, ensuring an uninterrupted workflow and immediate insights.

Mobile App

Stay informed wherever you are with our mobile app, the perfect companion for professionals who demand excellence at their fingertips.