It’s hard to make confident calls when fundamentals point one way, market pricing another, and documentation risks lurk in the fine print. That’s why we built three scoring lenses so you can see the whole picture and act with conviction: CS View for relative value, CoreScore for durability, and Documentation Scores for covenants and structure. Together, they help you answer the practical questions that drive performance, such as “Is this issuer’s credit strength improving or deteriorating over my investment horizon?”, “Is the market compensating me enough for the risks I see?”, and “What protections or structural features do I need to preserve value if the cycle turns?”

With these scores on a common, comparable scale, you can move from fragmented inputs to a unified decision framework.

Why Multiple Scores

No single metric captures the full picture of credit risk and relative value. Credit quality evolves, legal guardrails shape outcomes through the cycle, and market pricing can create misalignments. Our framework addresses three dimensions:

Relative value: Are we being paid appropriately for the risk versus the sector or peers?

Fundamental durability: What is the issuer’s underlying credit quality and resilience?

Legal protection: How strong are the covenants and structural protections supporting creditors

Deep Dive into Each Score

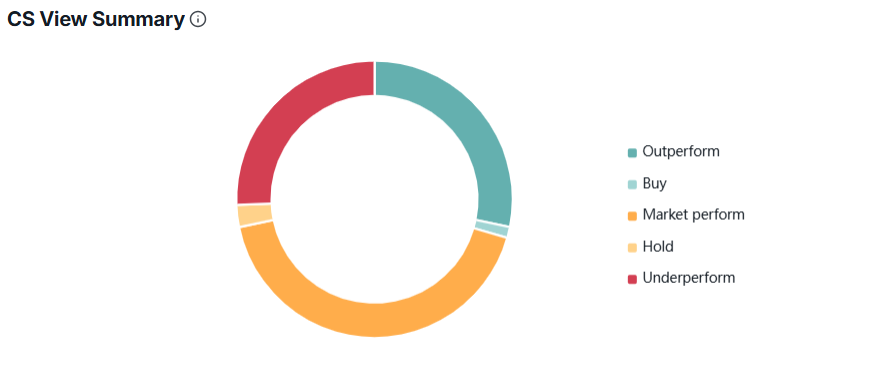

1. CS View: Your top-line stance and issuer-level relative value

CS View is our issuer-level view of expected excess returns relative to a sector or defined peer set, defined by the following performance ratings:

- Outperform: Expected excess return greater than the sector/peers

- Market Perform: Expected excess return broadly in line with the sector/peers

- Underperform: Expected excess return less than the sector/peers. When sector comparisons are less appropriate, we specify the peer set used.

How it’s used

- Trade selection: Identify where risk-adjusted returns look attractive versus sector or peers.

- Timing: Lean into catalysts (positive or negative) not fully reflected in pricing.

- Portfolio construction: Tilt exposure based on comparative value, not just absolute spread levels.

CS View translates valuation versus peers and curves into clear signals you can pair with CoreScore to time adds, trims, and sizing. It focuses on where spreads look attractive or rich today and can flag preferred points on the curve.

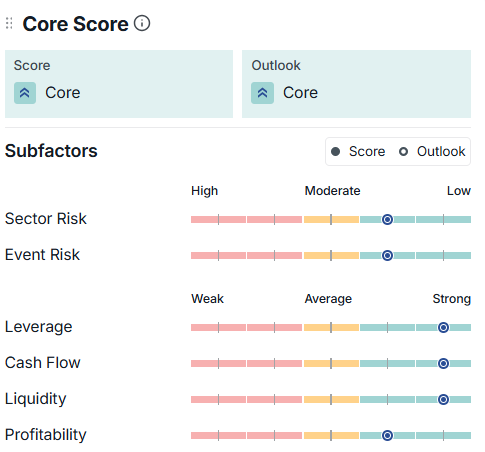

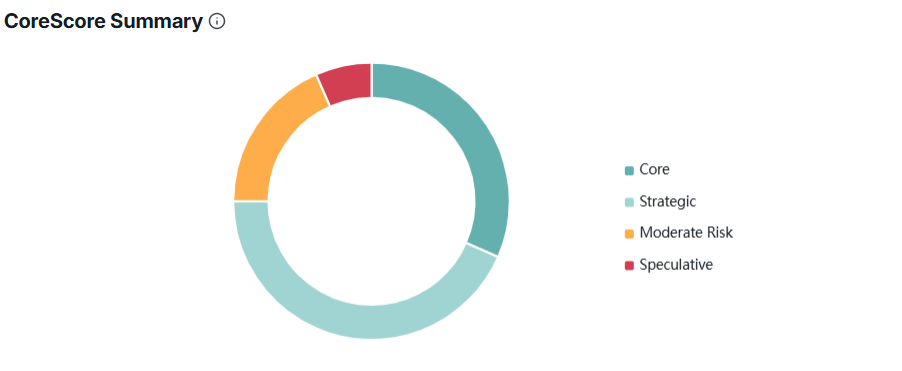

2. CoreScore: Grounding the credit view in fundamentals

CoreScore provides a deeper dive beneath the CS View, offering additional detail and context that helps you understand the factors behind the analyst’s assessment.

You’ll get our holistic view of an issuer’s credit strength, designed to support buy-and-hold decisions and identify long-term total return opportunities. It is built on six underlying credit factors and expressed on a four-point scale:

- Core: Very stable, high-quality credit profile

- Strategic: Strong, resilient profile with manageable risks

- Moderate Risk: Mixed profile with identifiable pressure points

- Speculative: Weak profile with elevated risk and lower recovery expectations

How it’s used

- Long-horizon positioning: Align with long-term portfolios seeking resilience or secular winners.

- Risk calibration: Distinguish volatility-driven issuers from structurally challenged credits.

- Monitoring: Track fundamental migration (improvement or deterioration) over time.

CoreScore distills issuer durability through the cycle into a single, comparable view you can use alongside CS View. It emphasizes balance sheet strength, cash flow resilience, and industry structure to screen names, validate long-term positions, and monitor evolving stories.

3. Documentation Scores: The legal layer that can shift outcomes

Documentation Scores (from Covenant Review) combines empirical analysis with qualitative legal expertise to assess covenant strength and structural protections. The scoring framework captures covenant nuances that can materially affect creditor outcomes.

How it’s used

- New issue evaluation: Gauge protections at launch and assess appropriate concessions.

- Negotiation leverage: Identify terms most relevant to downside risk and recovery.

- Ongoing surveillance: Track documentation drift and sponsor behavior across cycles.

Documentation Scores are separate from CoreScore and CS View and are most useful when structure matters such as comparing tranches, avoiding leakage risk, and prioritizing instruments with stronger investor safeguards. Plus, we’ve just made Documentation Scoring smarter. You can read more about the updates here.

How the Lenses Work Together

Think of each score as a layer in the investment decision stack:

- CS View: Are we being adequately compensated today versus sector and peer alternatives?

- CoreScore: Can this credit strengthen the portfolio through the cycle?

- Documentation Scores: How well is the position protected if conditions deteriorate?

Practical Tips for Investors

Here’s a look at ways you can use these scores in your workflow. Start by grounding your thesis with the fundamentals score, then test market compensation with the relative value score, and finally set protections, sizing, and timing with the documentation/structure score. Used together, the scores help you move from insight to action with greater confidence and consistency.

- Align horizon to the tool: Use CS View for trade selection and timing, CoreScore for strategic positioning, and Documentation Scores for protection checks.

- Watch for divergence: If CS View is Underperform but CoreScore is strong, the credit may be solid while pricing is rich. Consider patience or curve selection.

- Track migration: Shifts in any one score can foreshadow changes in the others (e.g., weakening documentation across a sponsor’s platform may presage future fundamental strain).

How to Apply the Scores

There are many ways to use the scores. To get the most from the scoring frameworks, here are examples of how you might react based on each score’s result.

CoreScore + CS View use cases

- When CS View is Outperform and CoreScore is high: You may want to maintain or modestly increase exposure. Use CS View to identify favored maturities; documentation can serve as a tie-breaker when selecting tranches.

- When CS View is Underperform and CoreScore shows moderate risk: Consider a cautious stance. Pricing looks less compelling relative to peers; evaluate alternatives with stronger fundamentals or more attractive relative value.

- When CS View is Market Perform and CoreScore is solid: Think about a selective approach. Monitor for better entry points or curve segments highlighted by CS View; keep the issuer on the watchlist.

- When CS View is Underperform and CoreScore is improving: Try monitoring for a potential inflection. Track fundamentals and watch for changes in CS View to identify dislocations or valuation shifts.

- When CS View is Outperform and CoreScore is weak: Explore tactical positioning. If engaging, keep tight risk parameters and reassess frequently given weaker fundamentals.

Documentation Scores (Covenant Review) use cases

- When Documentation Scores are strong: Think of prioritizing tranches or structures with stronger protections when you have choice among bonds or loans. Strong documentation can help mitigate downside and leakage risk, especially in high yield, leveraged loans, or complex indentures.

- When Documentation Scores are weak: You may want to favor secured or covenant‑heavy alternatives or reduce reliance on structures with limited protections. Use the score to differentiate among tranches and avoid features that increase flexibility for issuers at investors’ expense.

Strong outcomes can come from integrating fundamentals, legal structure, and market pricing. CS View, CoreScore, and Documentation Scores are designed to support that integration, helping you see the broader picture and calibrate positioning.