AT&T/EchoStar: Mega-MHz Deal

Davis Hebert, CFA - Co-Head HY Research, Head of Telecom/Media, CreditSights

Joshua Kramer - Senior Analyst, Special Situations, CreditSights

Mark Lightner, Esq. - Head of Special Situations Legal Research, CreditSights

Hunter Martin, CFA - Head of Media/Cable, CreditSights

Savannah Buzzeo - Analyst, Telecom/Media, CreditSights

Brian McKenna - Analyst, Telecom & Media/Cable, CreditSights

5 September 2025

Insights into AT&T’s $23B spectrum buy, 5G impact, capital structure, EchoStar deleveraging, valuation, and regulatory outlook, including:

- Deal scope and strategic rationale: What AT&T is buying (30 MHz at 3.45 GHz and 20 MHz at 600 MHz) and how it boosts 5G coverage, capacity, and fixed wireless access.

- AT&T financial impacts: How the all-cash price affects leverage and cash flow, expected accretion timing, and implications for capital allocation.

- EchoStar balance-sheet reset: How proceeds are used to repay debt and intercompany loans, easing credit risk and enabling future strategic options.

- Valuation and market signals: The implied $/MHz-POP pricing, how it compares with past auctions, and what it suggests about remaining DISH/EchoStar spectrum value.

- Regulatory and competitive outlook: Closing timeline and FCC considerations, network deployment implications, and what comes next for AWS-4 monetization.

Executive Summary

-

AT&T lifts 50 MHz of spectrum from EchoStar for $23 billion. AT&T announced an agreement to acquire 50 MHz of nationwide spectrum from EchoStar for $23 billion, all-cash, with anticipated closing for mid-2026, pending regulatory approvals. The spectrum being acquired consists of 30 MHz of 3.45 GHz licenses and 20 MHz of 600 MHz licenses. Using 325 million POPs, the valuation is implied to be ~$1.40 per MHz POP, although AT&T did not break out the price tag by band. We believe AT&T is paying a fairly full price for spectrum, somewhat surprisingly so, given Charlie Ergen’s precarious position.

-

AT&T confidently leaning into Fiber & 5G. AT&T says the deal will take leverage up about a half-turn to ~3x, which is above its 2.5x leverage target. It is maintaining its $20 billion share authorization program and reiterated both its 2025 and long-term financial guidance metrics. While we acknowledge the higher financial risk, we have been encouraged by the success of AT&T’s fiber and 5G strategy and believe the incremental spectrum will strengthen the company’s position in both coverage (600 MHz) and capacity (3.45 GHz), expand its FWA footprint and bring forward potential convergence opportunities given the longer investment timeframe for FTTH.

-

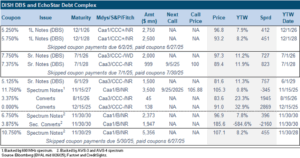

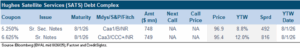

V-Day for Charlie: Move to Buy from Hold on DBS. The deal is a huge win for the heavily-indebted EchoStar capital structure. We believe the use of proceeds will be as follows: 1) repay the 11.75% Notes backed by the 600 MHz licenses, 2) repay the $7.2 billion intercompany loan backed mostly by 3.45 GHz licenses, including $2.7 billion held at DBS, 3) repay front-end 2026 maturities at DISH DBS, 4) repay front-end 2026 maturities at Hughes and 5) potentially additional debt repayment at DBS and investments in the company’s ambitions to be a D2D satellite player using S-Band licenses. We still think there is more juice in the DBS bonds (8% to 11% yields) and are moving to Buy from Hold and reiterate our Buy on Hughes bonds, which still trade at modest discounts to par.

Transaction Overview

AT&T announced an agreement to purchase 50 MHz of virtually nationwide spectrum from EchoStar (SATS) for $23 billion in cash, subject to certain adjustments, consisting of 30 MHz of the 3.45 GHz spectrum and 20 MHz of the 600 MHz licenses. Additionally, the two agreed to amend their long-term wholesale network services agreement to allow EchoStar to continue as a “hybrid” mobile network operator with the Boost Mobile service and AT&T to serve as the primary network partner. In a separate press release, EchoStar says the transaction is part of “ongoing efforts” to resolve FCC “spectrum utilization concerns” as it evaluates strategic options for the rest of its spectrum portfolio. The transaction is expected to close by mid-2026, subject to regulatory approvals, and we note that there is no break-up fee if the deal is blocked. Net net, this deal is a huge positive for complicated EchoStar capital structure, while we think post-transaction AT&T will have a stronger competitive position in wireless (mobile and FWA) that helps offset concerns about the leveraging impact (about 0.5x increase to ~3x debt/EBITDA).

EchoStar (DISH/SATS) Impact

Victory Day for DISH/SATS structure. There have undoubtedly been many twists and turns in the EchoStar/DISH credit story over the last decade, and this deal puts the credit on a path to a potentially ceremonious end. SATS is selling only a portion of its spectrum (50 MHz out of an average of 144 MHz, including CBRS) for $23 billion, which comes close to covering its entire debt load ($26 billion), not to mention the $4.3 billion of cash that EchoStar already had on its balance sheet as of June 30. In the press release, EchoStar says it would use proceeds from the deal for “retiring certain debt obligations and funding EchoStar’s continued operations and growth initiatives.” We assess the potential use of proceeds below: