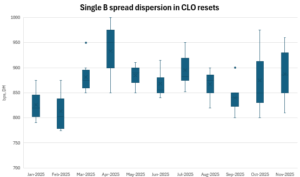

Pricing dispersion in sub-investment grade tranches for European CLO resets has intensified into the year-end as idiosyncratic credit problems prompt investors to redouble their scrutiny of portfolio quality and manager performance.

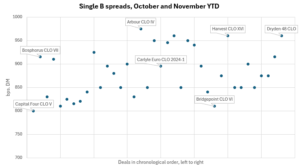

Single B rated tranches of resets from October and November have priced as tight as 800bps and as wide as 975bps DM, according to LFI data, compared with a much narrower range in the previous six months. September’s range was, for example, 800-850bps, with just one outlier at 900bps DM.

CLO investors welcome this long-awaited dispersion – or tiering – as a sign of a properly functioning market. It creates the opportunity to move down the stack or buy lower-quality pools at levels where the risk is now appropriately rewarded, say sources.

Portfolio clean-up prior to coming to market is a key determinant of reset pricing in the current climate, along with historical performance within management platforms, say investors.

“If there’s a concentration in Triple Cs going into the reset, we generally want to see an attempt to clean that up,” Rondeep Barua, portfolio manager at Ninety One said, noting that appetite remains “price dependent”.

“We’re happy to look at a weaker name going through a reset if there are mitigating factors: if it’s a manager we like, for example, or if there’s decent spread pick-up,” he added.

A new equity contribution can help repair credit enhancement while diluting exposure to the tail of the portfolio. In some cases, short-dated profiles can also be appealing, Barua added.

Despite a wave of leveraged loan downgrades in recent months, European CLOs look set to finish the year with lower average Triple C exposure than they began. In particular, Moody’s Triple C buckets have declined to ~4.5% on average, down from 5.3% at the start of the year, according to a recent Deutsche Bank report.

That said, investors are watching CLO MVOC levels closely, as these metrics would be the first to show meaningful deterioration if idiosyncratic issues accumulate in portfolios.

First Brands’ bankruptcy was a “shot across the bow”, one investor commented, and has prompted managers to scrub books, reassess what they want to own, and exit weaker names at acceptable prices.

Anna Carlisle

anna.carlisle@levfininsights.com

+44 (0)20 7469 0981