European Liability Management 2025 Year in Review: European LMTs Have Landed

Aggressive liability management tactics have officially arrived in Europe. This year-in-review explores how 2025 became a watershed moment for creditor-on-creditor violence, with marquee deals like Selecta, Victoria, and Altice showcasing priming maneuvers that left minority holders blindsided. From antitrust challenges to distressed disposals, discover the bold restructuring tactics reshaping European debt markets and why 2026 promises even more fireworks.

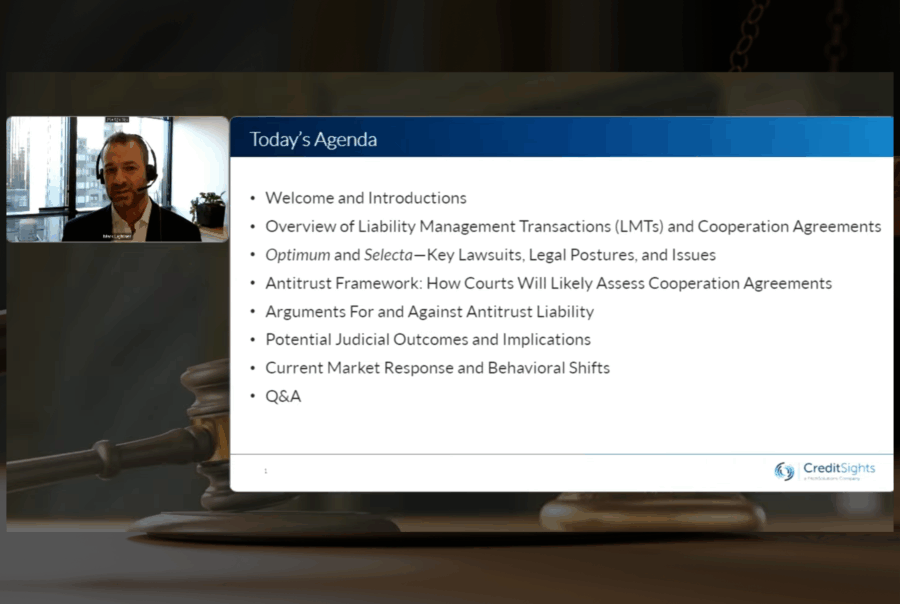

Cooperation Agreements & Antitrust: Webinar Recap

On January 13, 2026, CreditSights hosted a special webinar and podcast entitled “Cooperation Agreements and Antitrust: The Next Major Battle.” The panel explored how creditor cooperation agreements function in out-of-court restructurings and their emergence as a response to liability management transactions

(uptiers, drop-downs, double-dips, etc.). The panel then did a deep dive into two headline antitrust lawsuits—Optimum Communications (f/k/a Altice USA) and Selecta.

2026 Euro Special Sits: Some Are More Equal

European restructuring enters a new era where creditors dominate, governments push back, and emergency equity injections have vanished, according to the latest market analysis.

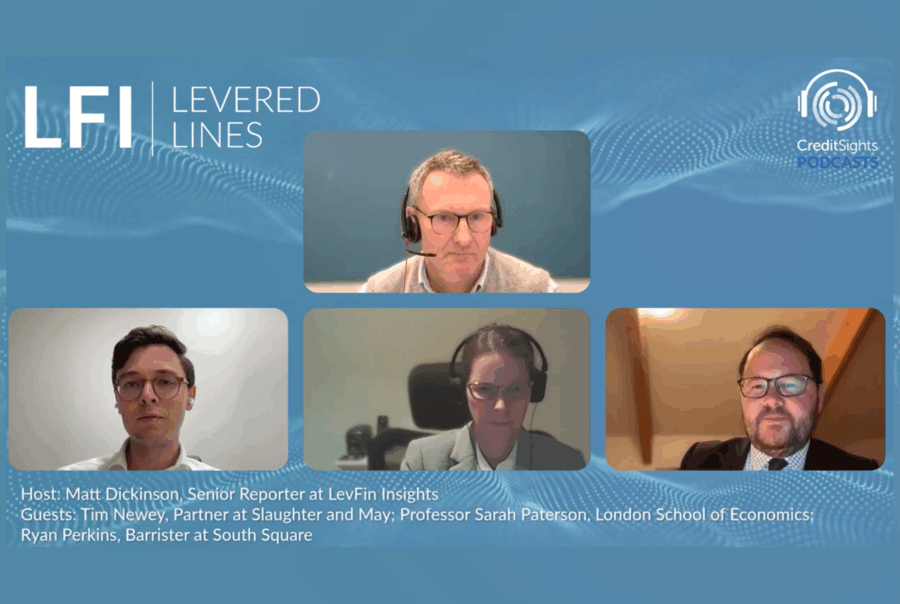

Levered Lines Podcast: Restructuring Plans – Reasons to be Cheerful as we head into 2026

Listen to LFI’s deep dive into the Thames case and into how RPs may develop next year in its latest Levered Lines podcast, with guests Tim Newey from Slaughter and May, Professor Sarah Paterson, and South Square’s Ryan Perkins.

E‑LEARNING SERIES

COVENANT FUNDAMENTALS

Supercharge your expertise with our Liability Management Transactions (LMT) module—part of our 11‑module e‑Learning series. Explore how LMTs are reshaping European leveraged finance, how they work in real deals, and where documentation gaps can put investors at risk.

Unlock Valuable

Insights with our

Free Resources

Explore a curated selection of in‑depth analyses from Covenant Review, CreditSights and LevFin Insights, covering major trends in European LMT structures, creditor dynamics and litigation developments.

Advance Your Understanding of European LMTs

Request a trial and discover how we provide clarity and insights amidst the ever-changing market landscape and news cycle.