Bonds Fluctuated

Case Study: Grifols

CreditSights delivers with another successful coverage of a Special Situations name

Overview

Grifols, a prominent international company historically operated like a private Catalan family business, has encountered significant governance challenges and financial turbulence exacerbated by Covid-19 disruptions and acquisition-driven debt. In 2024, the company’s bond market activity reflected heightened volatility, predominantly influenced by the potential Brookfield takeover deal. Despite the SEC concluding its investigation without sanctions, governance concerns and shareholder pressures persisted. The situation intensified with Brookfield’s attempts to secure financing and negotiate share discounts, culminating in their withdrawal from the bid in November. As a result, Grifols’ bonds, particularly the Senior Secured Notes, faced significant asymmetrical risk, prompting a re-evaluation of investment recommendations amidst a backdrop of corporate restructuring and asset sales.

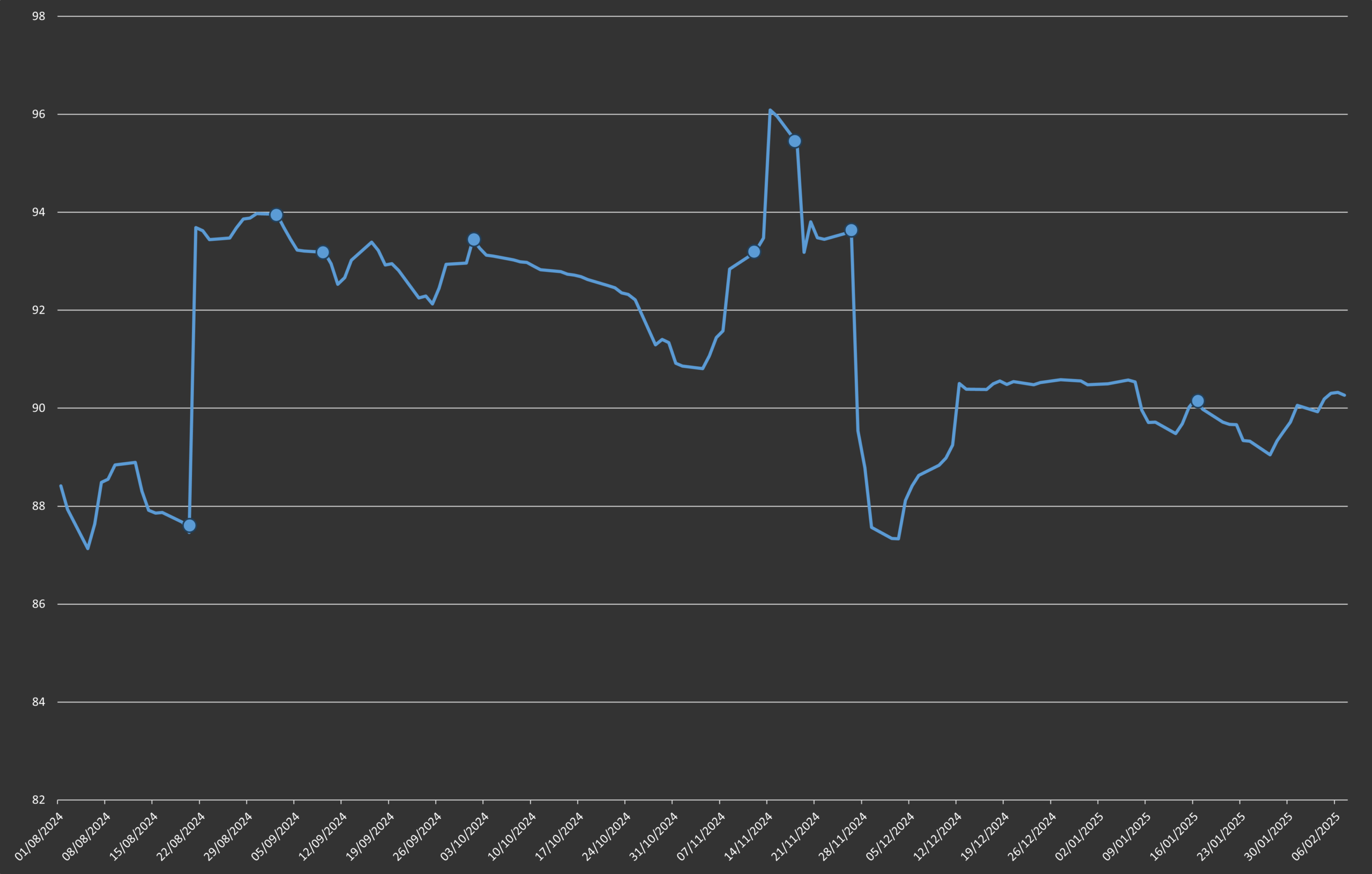

Grifols 2028 Senior Unsecured Notes

(cents)

How We Help

Got a Special Situation? Our team of over 150 analysts, lawyers, and journalists work together to provide our clients with the news and insights that can quickly change the valuation of names like Grifols.